Furthermore, operators must be aware of any local regulations that may impose additional bonding requirements.

Furthermore, operators must be aware of any local regulations that may impose additional bonding requirements. Municipalities may have specific laws governing tire storage, which can differ from state regulations. It is crucial for operators to conduct thorough research and consult with legal experts to ensure they are fully compliant with all applicable laws at both state and local levels.

How often do I need to renew my mortgage bond?

Illinois Mortgage License Bonds must be renewed annually to ensure ongoing compliance with state regulations. It is essential for lenders to keep track of renewal deadlines to avoid any lapses that may affect their ability to operate legally.

Furthermore, the lack of a bond may deter potential customers and partners from engaging with the distributor. In a competitive market, trust and credibility are paramount. Distributors who fail to demonstrate compliance with state regulations may find it challenging to attract clients, ultimately affecting their bottom line. Thus, while the bond may seem like an additional expense, it is a necessary investment in the long-term viability and success of the business.

This table summarizes the key requirements for obtaining and maintaining Illinois Mortgage License Bonds, providing an at-a-glance view for lenders. Understanding these requirements enables lenders to prepare effectively and ensure they remain compliant with state laws.

The Bond Filing Process

The process of filing for an Illinois Tire Storage Bond involves several key steps that operators must follow to ensure compliance. Initially, operators need to determine the appropriate bond amount based on their specific business needs and regulatory requirements. This often involves assessing the volume of tires stored and any relevant local regulations that may impact bonding amounts.

Factor

Impact on Approval Times

Recommended Solutions

Application Complexity

Increases time due to extensive documentation

Simplify forms and utilize standardized templates

Stakeholder Communication

Delays due to lack of clarity

Regular meetings and updates to enhance understanding

Technological Integration

Can either speed up or slow down processes

Invest in user-friendly digital platforms

Regulatory Changes

Can introduce unexpected delays

Stay informed and adapt processes quickly

Navigating the world of Illinois CDL certification bonds can be a daunting task, particularly for business professionals and contractors eager to ensure compliance and secure their operations. In Illinois, these bonds serve as a critical requirement for obtaining a Commercial Driver's License (CDL). They not only protect the interests of the state but also provide a safety net for the general public. Understanding the approval process and requirements is essential for those looking to operate legally while avoiding unnecessary delays.

Many retailers may seek assistance from professional bonding agents or brokers who specialize in liquor bonds. These professionals can help navigate the complexities of the bonding process, ensuring that retailers find the best rates and coverage options available. By leveraging the expertise of a bonding agent, retailers can save time and potentially money in the long run, allowing them to focus on their core business operations.

Frequently Asked Questions

What is the purpose of an Illinois CDL certification bond?

The purpose of an Illinois CDL certification bond is to ensure compliance with state regulations governing commercial driving. For a practical reference,

Waste Tire Facility Surety Illinois for a deeper dive. It protects the interests of the public and the state by guaranteeing that licensed drivers adhere to safety standards and legal requirements.

In addition to meeting the bond requirement, applicants must also be aware of the financial implications involved. Many surety companies evaluate the financial background of the applicant before issuing a bond. This means that demonstrating a strong credit history and financial stability can significantly impact the approval process. Understanding these nuances is key to ensuring a smooth application.

How much does it cost to obtain an Illinois Mortgage License Bond?

The cost of an Illinois Mortgage License Bond typically varies depending on the lender's creditworthiness and the bond amount. Most lenders can expect to pay a premium that is a percentage of the total bond amount, which is generally set at $25,000. Lenders with better credit scores may secure lower premiums.

In this article, we will explore the fundamentals of Illinois Liquor Permit Bonds, detailing what retailers must file and the implications of these requirements on their business operations. From understanding the bond's purpose to the application process and common challenges faced by retailers, this guide aims to provide clarity and actionable insights. By breaking down this complex topic, we hope to empower Illinois retailers to navigate the requirements with confidence and ease.

Navigating the Essentials of Illinois Surplus Lines Producer Bonds for Insurance Agents

Navigating the Essentials of Illinois Surplus Lines Producer Bonds for Insurance Agents

Navigating the Landscape of Illinois Liquor Permit Bonds: Essential Insights for Retailers

Navigating the Landscape of Illinois Liquor Permit Bonds: Essential Insights for Retailers

Unlocking Efficiency: How New Lenox Contractors Streamline Licensing with Surety Bonds

Unlocking Efficiency: How New Lenox Contractors Streamline Licensing with Surety Bonds

Navigating the Requirements for Illinois Tire Storage Bonds: A Comprehensive Guide for Operators

Navigating the Requirements for Illinois Tire Storage Bonds: A Comprehensive Guide for Operators

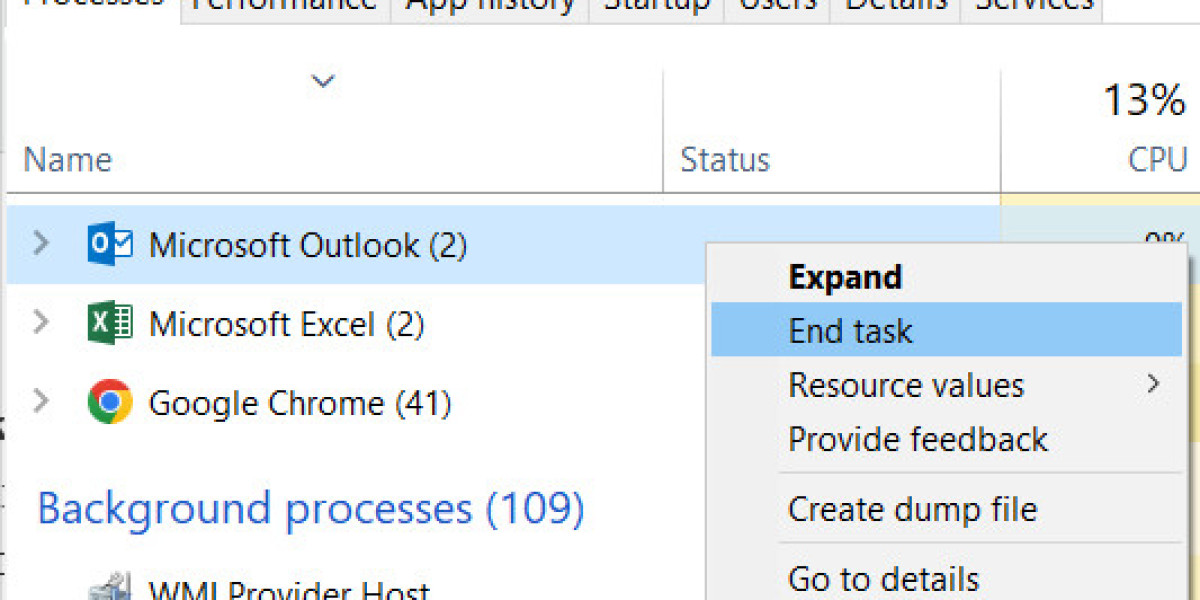

Outlook wont open or is stuck at loading profile

Outlook wont open or is stuck at loading profile