Additionally, maintaining a strong relationship with your bonding agent can provide valuable insights and updates on industry changes that may affect your bonding requirements.

Additionally, maintaining a strong relationship with your bonding agent can provide valuable insights and updates on industry changes that may affect your bonding requirements. To dig a bit deeper, Illinois License Surety for a deeper dive. These professionals can offer guidance on securing additional bonds for new projects or adjusting existing ones based on your business growth. Engaging in regular communication will ensure that you are always in compliance and ready for new opportunities.

Understanding the importance of Illinois Distributor Bonds not only aids in compliance but also enhances a company's overall operational efficiency. These bonds are designed to protect consumers and the state from financial loss due to the failure of a distributor to comply with licensing requirements. Consequently, this guide will explore the essential aspects of these bonds, providing practical insights into their application and benefits for importers.

Moreover, it is essential for contractors to recognize that the specifics regarding Union Wage Bonds can vary based on the nature of the project and the local jurisdiction. Some municipalities may have additional requirements or stipulations attached to these bonds, necessitating a thorough understanding of local regulations. Engaging with a bonding professional or legal advisor can be invaluable in navigating these complexities and ensuring that all obligations are met.

After submitting the application, the bonding company will conduct a thorough review, which may include a credit check and an evaluation of the contractor's past projects. For additional perspective, Illinois License Surety if you want to explore further. This review process is crucial as it determines the bond's approval and the premium amount. Contractors should be prepared to answer any additional questions the surety may have and provide further documentation if needed. Quick and transparent communication can expedite this process.

Conclusion

In conclusion, understanding Illinois Union Wage Bonds is essential for contractors aiming to maintain compliance and enhance their business operations. To dig a bit deeper,

Illinois License Surety for more details. By recognizing the importance of these bonds in safeguarding worker rights, improving credibility, and accessing a broader range of contracts, contractors can position themselves for success in the competitive Illinois market. It is critical for contractors to navigate the bonding process carefully, ensuring all requirements are met while also staying informed about changes in regulations. Ultimately, a proactive approach to bonding not only reinforces compliance but also fosters strong relationships with unions and enhances overall project success.

This table outlines the various bond types relevant to contractors in Illinois, including their typical amounts and eligibility criteria. Knowing these details can help contractors prepare effectively when seeking bonds.

While the new Illinois Union Wage Bond requirements in 2025 present certain challenges, the overall advantages of improved labor standards and competitive equity outweigh the drawbacks. By prioritizing compliance, contractors can position themselves for success in a rapidly evolving market.

Additionally, importers may struggle with maintaining compliance after securing the bond. Regularly reviewing state regulations and staying informed about any changes is crucial. Businesses should develop a compliance strategy that includes ongoing education and training for staff to ensure everyone understands their obligations under the bond.

In Illinois, union wage bonds serve a significant role in protecting labor rights and ensuring that workers are compensated fairly. The introduction of updated requirements in 2025 is not merely a bureaucratic hurdle; it represents a shift towards greater accountability within the industry. For small to mid-sized businesses, particularly those with fewer than 50 employees, grasping the implications of these changes is vital. This article will explore the new requirements, the rationale behind them, and how businesses can effectively comply to avoid penalties and disruptions in their operations.

Furthermore, the financial benefits of securing a bond extend beyond compliance. A valid distributor bond can enhance an importer’s credibility with suppliers and customers, potentially leading to better business opportunities. Having a bond in place signals to partners that the importer is responsible and committed to operating within the legal framework, which can foster trust and facilitate smoother transactions.

Moreover, any claims made against a bond can have serious repercussions. If a claim is filed due to a tester's failure to comply with regulations, the surety company may investigate the situation. If the claim is found valid, the surety will pay the claim amount, which the tester will then need to reimburse. Understanding the implications of claims and maintaining a proactive approach to compliance can significantly reduce the risk of facing such challenges.

Navigating the Essentials of Illinois Surplus Lines Producer Bonds for Insurance Agents

Navigating the Essentials of Illinois Surplus Lines Producer Bonds for Insurance Agents

Navigating the Landscape of Illinois Liquor Permit Bonds: Essential Insights for Retailers

Navigating the Landscape of Illinois Liquor Permit Bonds: Essential Insights for Retailers

Unlocking Efficiency: How New Lenox Contractors Streamline Licensing with Surety Bonds

Unlocking Efficiency: How New Lenox Contractors Streamline Licensing with Surety Bonds

Navigating the Requirements for Illinois Tire Storage Bonds: A Comprehensive Guide for Operators

Navigating the Requirements for Illinois Tire Storage Bonds: A Comprehensive Guide for Operators

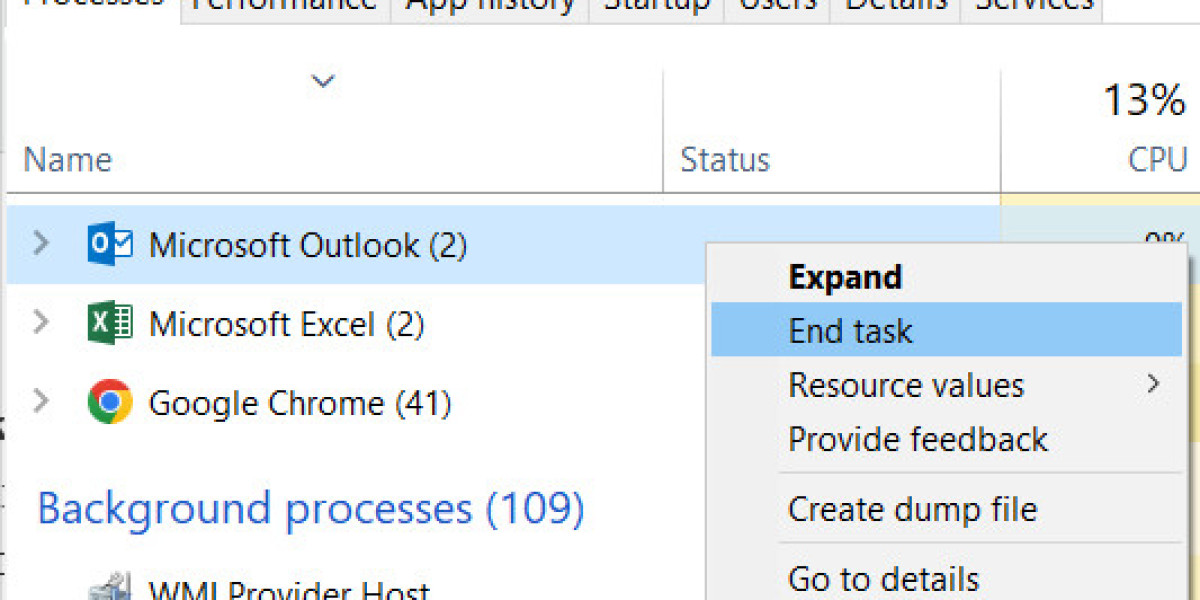

Outlook wont open or is stuck at loading profile

Outlook wont open or is stuck at loading profile